Si te encuentras en situación de desempleo, es posible que hayas oído hablar de la capitalización del paro. Esta opción puede ser interesante para aquellas personas que están cobrando la prestación por desempleo y que quieran emprender en un nuevo negocio. Esta es una opción en la que los desempleados solicitan al Estado cobrar todo su paro de una sola vez, para poder invertir ese dinero en la creación de una empresa. De esta forma, los desempleados pueden transformar una mala situación en una oportunidad para emprender su propio negocio y tener éxito empresarial.

La capitalización del paro es una opción cada vez más valorada entre los españoles. Cada año hay decenas de miles de solicitudes nuevas para obtener esta ayuda económica y convertirse en autónomos, socios de una SL o socio trabajador de una cooperativa o sociedad laboral.

¿Quién puede solicitar el pago único del desempleo?

Existen una serie de requisitos para poder obtener esta ayuda al emprendimiento. Estas condiciones son una medida para asegurarse de que quien solicita este pago está realmente interesado en comenzar una nueva aventura empresarial. Conviene tener muy claras las cuestiones previas para comenzar un negocio antes de solicitar esta ayuda, especialmente si tenemos en cuenta la necesidad de presentar una memoria de la actividad para su aprobación.

Requisitos para poder solicitar este pago único:

- No haber iniciado la actividad económica sin el alta en la Seguridad Social.

- Tener pendiente de recibir, al menos, 3 meses de prestación.

- No haberse beneficiado de otro pago en los 4 años anteriores.

- Acreditar el alta como autónomo o la incorporación como socio trabajador de una cooperativa, sociedad laboral o mercantil.

- Iniciar la actividad en el plazo máximo de un mes.

- No haber impugnado el despido por el que se encuentra en situación de desempleo.

Cabe aclarar que, en el caso de que haya una impugnación en el despido, es necesario esperar a que se haya resuelto el expediente de impugnación para solicitar el pago único.

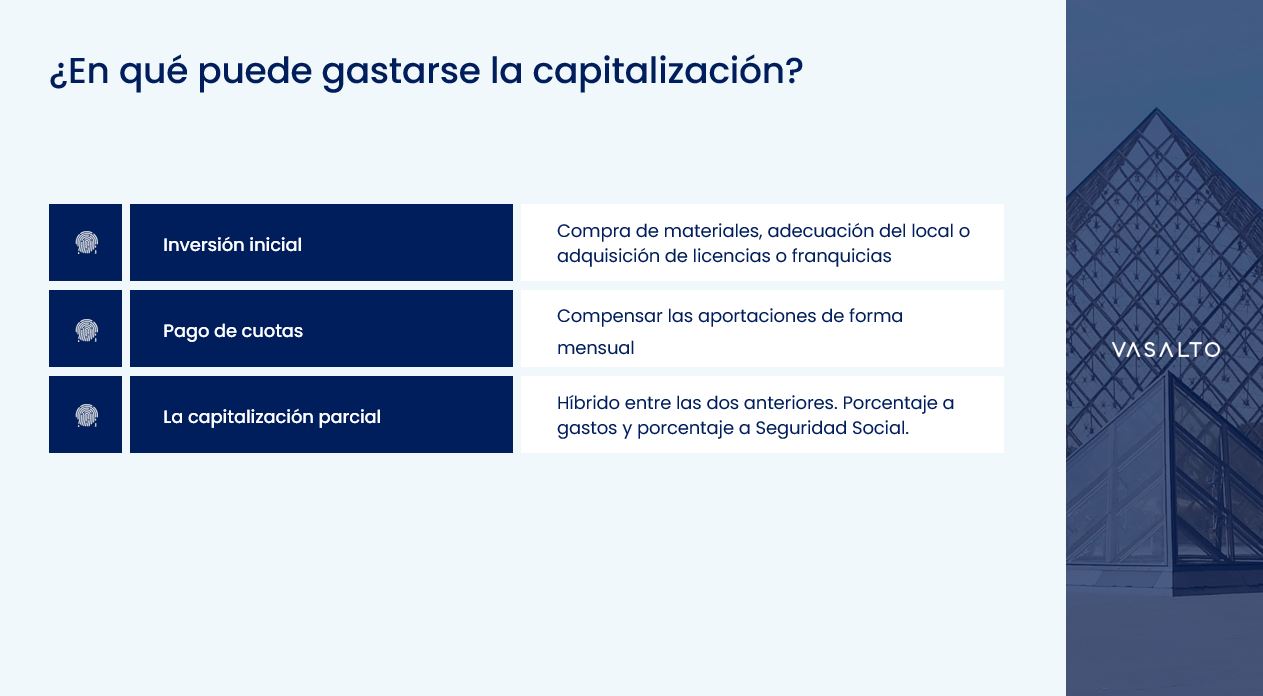

¿En qué puede gastarse la capitalización?

Muchas de las solicitudes para el pago único de la prestación por desempleo están destinadas a convertirse en autónomos. También puede ser requerido para la fundación de una SL. En otras ocasiones, se pretende pasar a ser socio trabajador de una sociedad laboral o cooperativa. Sea cual sea el caso, es necesario aclarar que este dinero no puede ser utilizado de forma completamente libre.

El Estado, al igual que sucede con la posibilidad de ejercer una solicitud, tiene previstos una serie de requisitos para cerciorarse de que ese dinero se destina a un fin legítimo. En función del uso que se le dé a este dinero, podemos dividir la capitalización en tres tipos: para la inversión inicial, para el pago de cuotas y la capitalización parcial.

Para la inversión inicial

Esta modalidad consiste en destinar el 100% de lo percibido en gastos para el nuevo negocio. Si estamos hablando de los autónomos, estos gastos se tendrán que justificar como compra de materiales, equipos o herramientas necesarias para la actividad económica (por ejemplo, comprar ordenadores, impresoras y mesas), gastos de adecuación del local en el que se va a ejercer la actividad o en la adquisición de licencias o franquicias, entre otros.

Si hablamos de una solicitud para las sociedades laborales o cooperativas o la fundación de una sociedad limitada, esta inversión deberá justificarse como aportaciones al capital social.

Para el pago de cuotas

En este caso, el dinero no se va a gastar en compra o en el pago de licencias, sino que se destina a pagar la cuota de autónomos. Una de las mayores preocupaciones de los españoles a la hora de comenzar un negocio de forma autónoma es la cuota de la Seguridad Social. Por eso, la posibilidad de destinar este dinero a cubrir ese gasto obligatorio puede ser una gran ayuda en los primeros pasos del nuevo negocio. En este caso no se le daría el dinero directamente al solicitante, sino que se le irían compensando las cuotas de forma mensual.

La capitalización parcial

Este modelo de capitalización no es otra cosa que un híbrido entre las dos anteriores. Si el solicitante no va a necesitar todo el dinero para la inversión inicial, este puede pedir que un porcentaje se destine a estas inversiones, y el resto será utilizado para compensar las cuotas a la Seguridad Social.

Esta situación puede darse, por ejemplo, en los casos de fundación de sociedades limitadas. El capital social mínimo a la hora de crear una SL es de 3.000 euros. Por tanto, puede darse el caso de que una persona tenga derecho a una prestación por desempleo mayor. En esta situación, una capitalización parcial se podría utilizar para pagar los 3.000 euros de capital social, dejando lo restante para compensar las futuras aportaciones a la Seguridad Social.

¿Cómo se solicita la capitalización del paro?

Para solicitar la capitalización del paro, una vez cerciorados de que cumplimos los requisitos explicados anteriormente, tendremos que acudir al Servicio Público de Empleo Estatal (SEPE). Esta solicitud se puede hacer tanto en el momento de tramitar la prestación por desempleo como en cualquier momento posterior. Recordemos que uno de los requisitos para esta capitalización es comenzar la actividad económica en el plazo máximo de un mes, por lo que es conveniente tener todo atado antes de hacer esta solicitud.

A la hora de hacer la solicitud, es necesario entregar dos documentos. El primero es el impreso de solicitud del pago único. Este es un documento oficial que se puede encontrar en la web del SEPE. El segundo documento es la memoria de solicitud del pago único del paro. Este documento es quizá el más importante de los dos. Es aquel que justifica a la administración en qué se va a gastar el dinero que se solicita. Este documento consiste en un informe detallado de por qué se pide esa cantidad de dinero y en qué se va a gastar. Como hemos visto, la administración es muy vigilante en el uso del dinero del paro, por lo que conviene que esta memoria sea lo más detallada posible.

Requisitos del SEPE para la memoria de solicitud:

- Datos personales.

- Datos de la empresa a crear o incorporarse (forma jurídica, descripción de la actividad, domicilio social de la empresa, domicilio del centro de trabajo, inicio de la actividad y contratación de trabajadores).

- Datos relativos a la sociedad.

- Datos relativos al proyecto: plan de inversiones, cuenta de pérdidas y ganancias y plan de financiación.

La capitalización del paro y el IRPF

Por último, una de las preguntas más frecuentes a la hora de hablar sobre la capitalización del paro es su relación con el IRPF. Esta ayuda del Estado tiene una exención triburaria, aunque está acogida a una condición: la actividad profesional debe realizarse por, al menos, 5 años. De no ser así, el pago único del desempleo se deberá tributar en el IRPF. Anteriormente existía un límite de 15.500 euros en esta exención. Este ha sido eliminado para fomentar que las personas en situación de desempleo puedan acogerse a esta opción.

¿Necesitas ayuda para capitalizar el paro?

En Vasalto somos expertos en gestión laboral. Estamos especializados en ayudar a empresas y autónomos con todos los procesos relacionados con la gestión de relaciones laborales. Si estás pensando en capitalizar el paro y necesitas asesoramiento, no dudes en llamarnos.

Nuestros más de 30 años nos han dotado de una gran experiencia en el sector. Además, somos una empresa muy involucrada con la tecnología. A lo largo de estos años hemos desarrollado una serie de sistemas informáticos propios que nos permiten gestionar más de 40.000 nóminas todos los meses. Además, también contamos con el mejor asesoramiento jurídico y contable, para ofrecer a nuestros clientes el mejor servicio posible.

En Vasalto creemos que la comunicación entre personas es fundamental. Nosotros ponemos la tecnología a disposición de las personas, nunca al revés. Trabajamos con soluciones tecnológicas de automatización para que la informática nos quite todo el trabajo posible. De esta manera, tenemos más tiempo para dedicarlo a nuestros clientes.